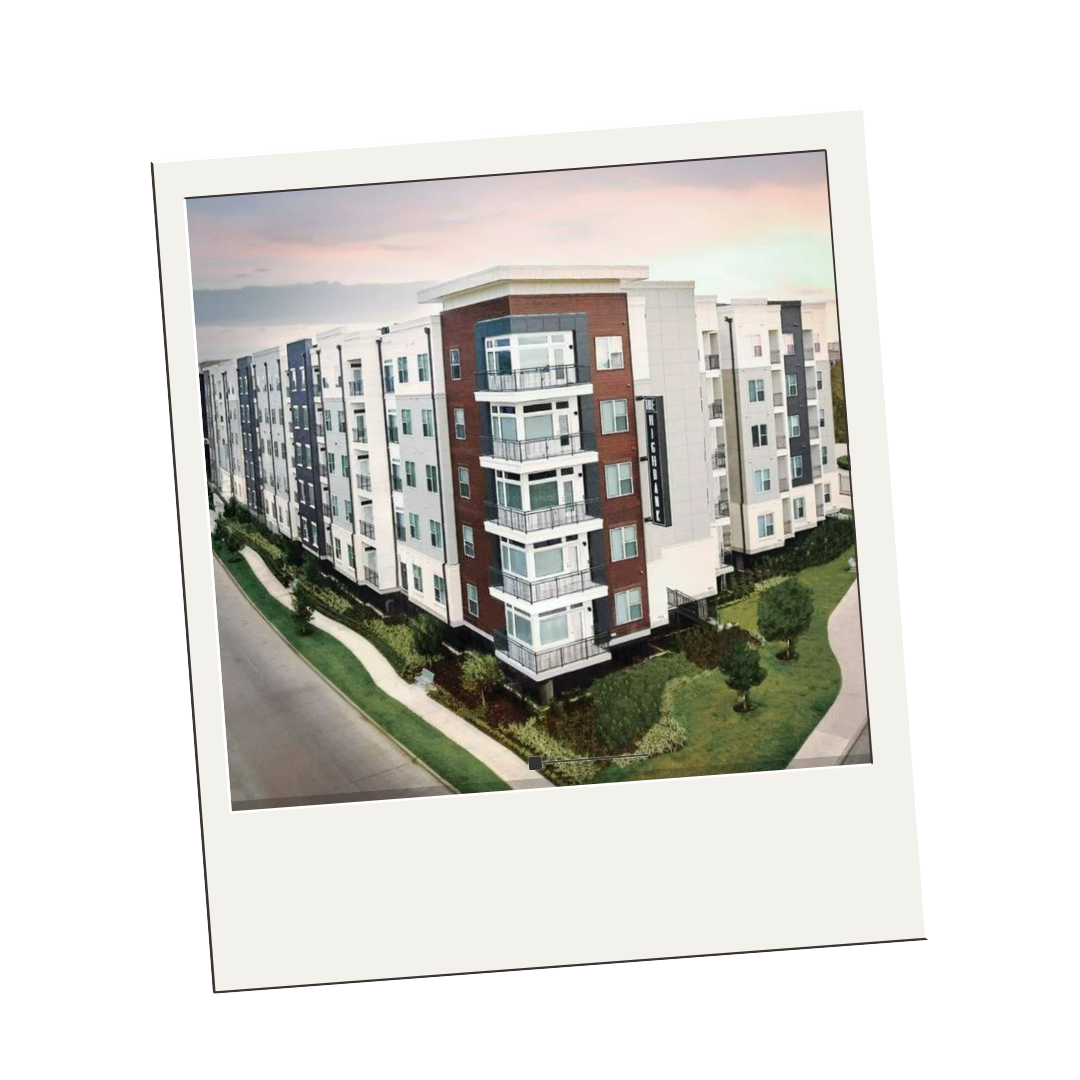

Built from Inspiration on 29th Street

Headquartered in Chicago, 29th Street is a privately held investment management firm focused on multifamily real estate and Proptech. We acquire, develop, renovate and manage multifamily communities nationwide, deploying our technology to enhance the resident experience and optimize property performance. Backed by more than 15 years of delivering above market returns across over $5.1 Billion in assets, our culture is driven by our Mission, Vision and Values.

2009 - Where It All Began

Stan Beraznik, a visionary entrepreneur, makes his first investment on the San Francisco court house steps. Located on 29th Street, this home was the first of over $5 billion in assets acquired by 29th Street Capital.

2012

- Achieved a total capitalization of $100 million

- Completed acquisition of 500th Single Family Rental (SFR)

- Formed a joint venture with an institutional partner for SFR

- Launched a Distressed Debt business unit

- Expanded into Atlanta, our fifth market

2013

- Robb Bollhoffer joins 29SC as Principal to focus on growing the multifamily platform

2014

- $100MM of equity raised

- Expanded into our 10th Multifamily market, Las Vegas

- 29SC Single Family merges with Florida-based SFR Operator

2015

- 29SC Single Family portfolio grows to over 2,000 homes with value over $500MM

- 6,000th Multifamily unit acquired

- Institutional Partner acquires SFR platform and goes public in Toronto

2016

- $400MM of total capitalization

- 50th Multifamily asset acquired

2017

- $200MM of equity raised

- Expanded into our 12th Multifamily market

2018

- Reached 10,000 units acquired

- Initiated strategy to reduce the average age of the portfolio by selling older, value add properties and acquire core plus assets via tax deferred exchanges

2019

- $500MM of total equity raised

- 15,000th unit acquired

- 29SC Development and Property Management units established

2020

- 20,000th Multifamily unit acquired

- During COVID our local presence in each market allowed us to closely monitor our assets and maintain contact with our residents, a key to outperforming the market during these difficult times

2021

- $3 Billion in total capitalization

- $1 Billion in capitalization in a single year

- Upgraded portfolio vintage by an average of 11 years since 2018

2022

- $5 Billion in total capitalization

- Delivered 1st development

- 29SC Ventures, our Proptech business unit was created

- Launched Preferred Equity platform

- First Proptech investment

2024

- Acquired 3rd multifamily property in San Antonio, TX

- Broke ground on two multifamily developments in AZ

- Lease-up activity began at The Hayley, our new development in Sacramento, CA

- Launched third-party property management services: 29SCLiving

2025

- Celebrated the grand opening of Origin Apartments, our newest development in Goodyear, AZ

- Kicked off lease-up at Verge, our third ground-up project in the Phoenix market

- Acquired Fenwick Apartments, a 311-unit Class A community in Silver Spring, MD

- 29th Street Living secured five new property management contracts

- Our Preferred Equity platform has closed 7 deals